What Topps Basketball Cards Are Worth Money are a versatile option for personal and expert projects. These templates are excellent for producing planners, invites, welcoming cards, and worksheets, saving you effort and time. With adjustable styles, you can easily adjust message, shades, and formats to match your demands, making sure every template fits your design and function.

Whether you're organizing your schedule or designing celebration welcomes, printable templates streamline the procedure. Available and easy to edit, they are perfect for both newbies and experts. Check out a variety of layouts to release your imagination and make customized, high-grade prints with marginal hassle.

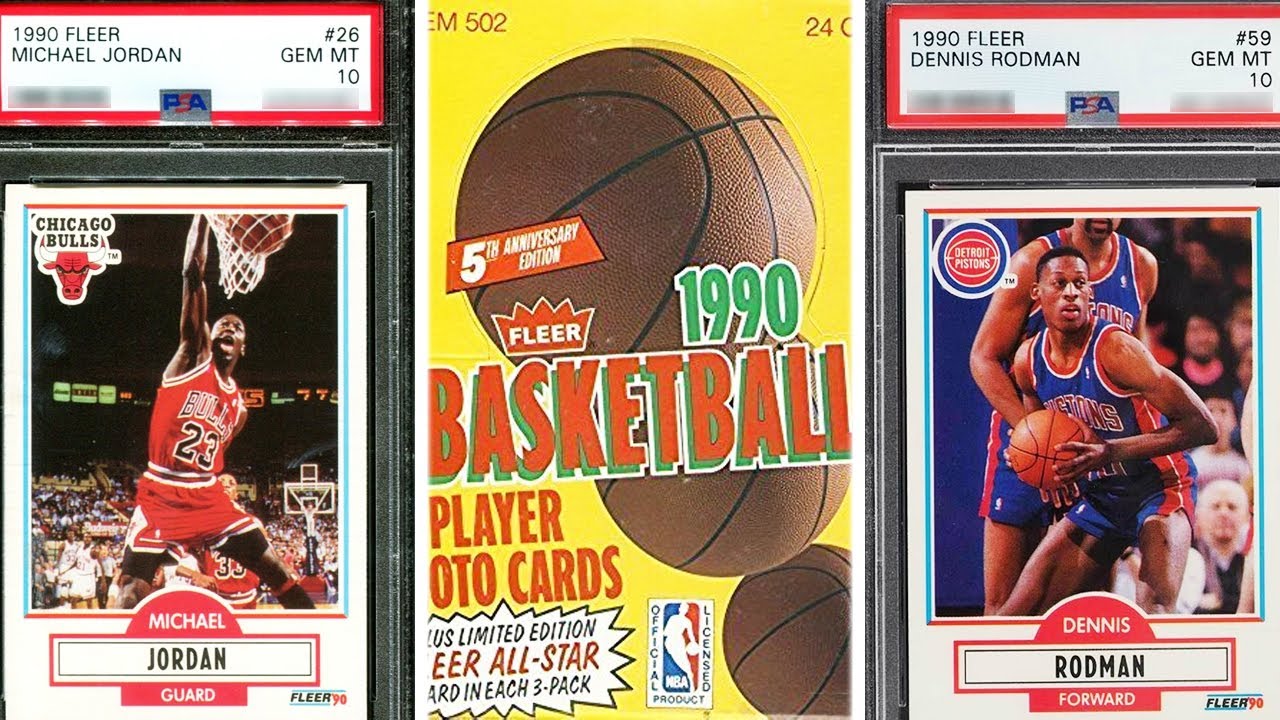

What Topps Basketball Cards Are Worth Money

What Topps Basketball Cards Are Worth Money

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Form W-9 ... Used to request a taxpayer identification number (TIN) for reporting on an information return the amount paid. Form W-9 PDF. Related:

W9 form ei sig pdf

2020 21 Most Valuable Rookie Nba Cards

What Topps Basketball Cards Are Worth MoneyForm MA- W-9 (Rev. April 2009). Print Form. Page 2. What Name and Number to. Give the Requester. For this type of account: Give name and SSN of: 1. Individual. Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Enter your TIN in the appropriate box. For individuals, this is your social security number (SSN) However, for a resident alien, sole proprietor, ... [img_title-17] [img_title-16]

Forms instructions Internal Revenue Service

[img_title-3]

W 9 blank IRS Form IRS Form W 9 rev March 2024 W 9 Form 2024 Washington University in St Louis Notifications [img_title-11]

Go to www irs gov FormW9 for instructions and the latest information Give Form to the requester Do not send to the IRS Print or type [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]