C 5 9 F 32 203 F C are a functional option for personal and expert jobs. These templates are best for creating planners, invites, greeting cards, and worksheets, saving you effort and time. With personalized designs, you can effortlessly change text, colors, and formats to fit your demands, making certain every template fits your style and purpose.

Whether you're arranging your schedule or developing celebration welcomes, printable templates simplify the procedure. Accessible and easy to modify, they are optimal for both novices and experts. Explore a wide variety of styles to release your creative thinking and make individualized, top notch prints with minimal headache.

C 5 9 F 32 203 F C

C 5 9 F 32 203 F C

Use Form 4868 to apply for 6 more months 4 if out of the country defined later under Taxpayers who are out of the country and a U S citizen or resident File Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. You can file by mail, online with an IRS e-filing partner ...

Application for Automatic Extension of Time To File U S Individual

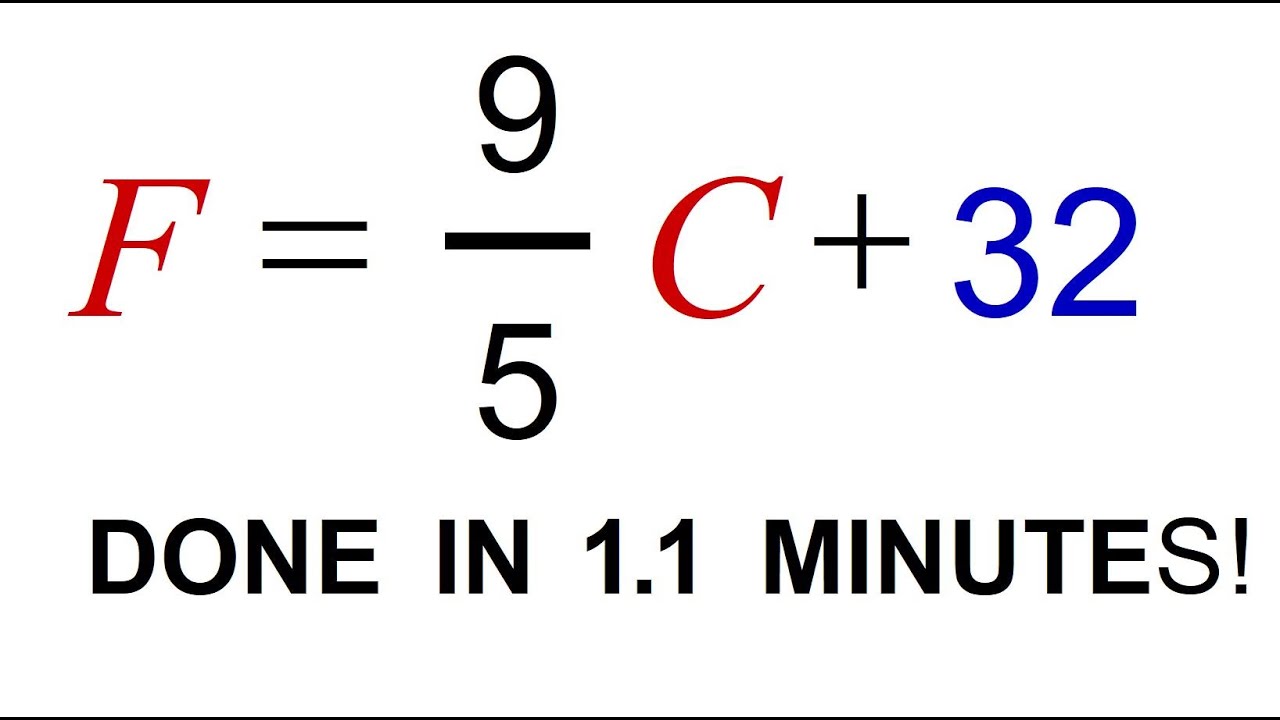

Solve Literal Equation Formula Solve For F In C 5 9 F 32 Use

C 5 9 F 32 203 F CThere are two methods for printing Form 4868 Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Form 4868 is used by individuals to apply for six 6 more months to file Form 1040 1040NR or 1040NR EZ A U S citizen or resident files this form to

Do not file Form 4868 if you want the IRS to figure your tax or you are under a court order to file your return by the regular due date. Form 709 or 709-A. Facebook Facebook

Get an extension to file your tax return Internal Revenue Service

F 9 5 C 32 Solve For C Working With Formulas And Algebra YouTube

Now you can get an automatic extension of time to file your tax return by filing Form 4868 electronically by April 16 2001 You will receive an electronic Facebook

If you wish to file on paper instead of electronically fill in the Form 4868 below and mail it to the address shown on page 4 Form 709 or 709 A Although an Facebook Facebook